The latest feature update that we have got for you is that now, you can automatically collect recurring payments directly from your customer’s bank accounts via e-NACH.

Now, PayU’s recurring platform allows a merchant to offer their customers standing instruction feature for Credit Card, selected Debit cards and Net Banking (e-NACH and e-mandate), through various integration methods.

What is e-NACH and e-mandate?

The Electronic National Automated Clearing House or e-NACH is the latest electronic payment system in India, developed by the NPCI (National Payments Corporation of India). With e-NACH, anyone with a bank account can automate transactions that are repetitive and periodic in nature.

Net Banking recurring, like cards, is processed seamlessly without customer’s intervention and without any 2nd-factor authentication.

There are 2 types of transaction:

- Registration transaction (also called e-Mandate transaction): This is usually 0 Rs transaction and hence it is called as registration transaction.

- Payment transaction (also called e-NACH transaction or SI transaction): When PayU/Merchant starts charging customer recurring payments, as per billing plan submitted during registration.

This is an extension to PayU’s comprehensive Subscription product suite bringing together all the payment methods such as Credit Cards, Debit Cards and Bank Accounts to handle recurring payments.

The customer will provide authorization with the choice of its preferred bank at the start of the billing cycle/subscription plan, and all subsequent payments will be fully automated thereon. PayU has already integrated with 21 leading bank accounts and counting, for collecting payments via e-NACH.

Collect Recurring Payments via e-NACH in Three Simple Steps:

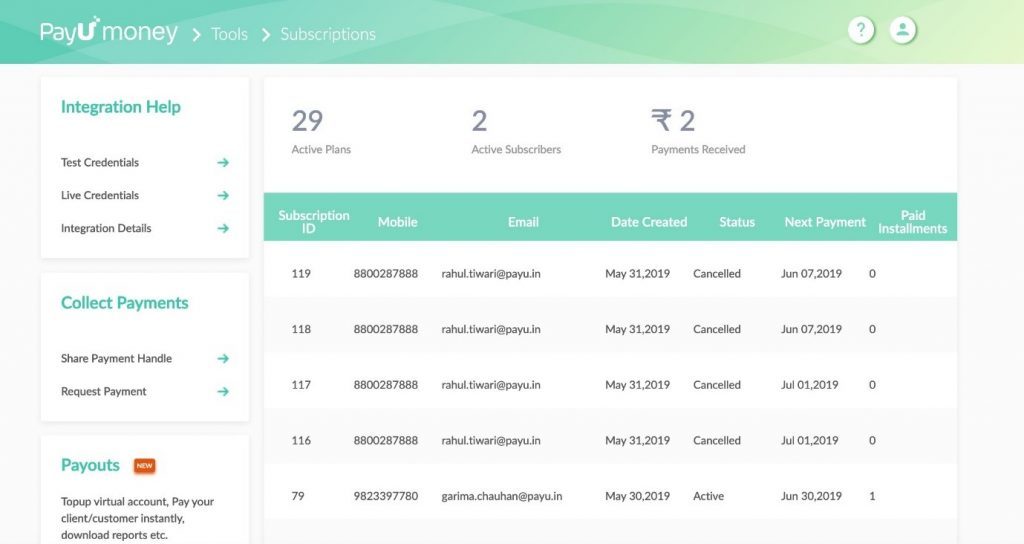

- Easily set up subscription plans that best meet your customer’s needs through our easy to use Subscription APIs, on your existing PayUmoney dashboard and invite your customers to use it.

- If interested, your customer receives a link to authorise payment through their preferred bank.

- PayU registers the customer’s mandates and brings you your money, in an automated way!

PayU Subscriptions helps you with all your subscription needs such as creating plans, tracking them and much more. Click on the link to know more about PayU Subscription-based payments and how to integrate it.

Step By Step Flow of Collecting Payments via e-NACH

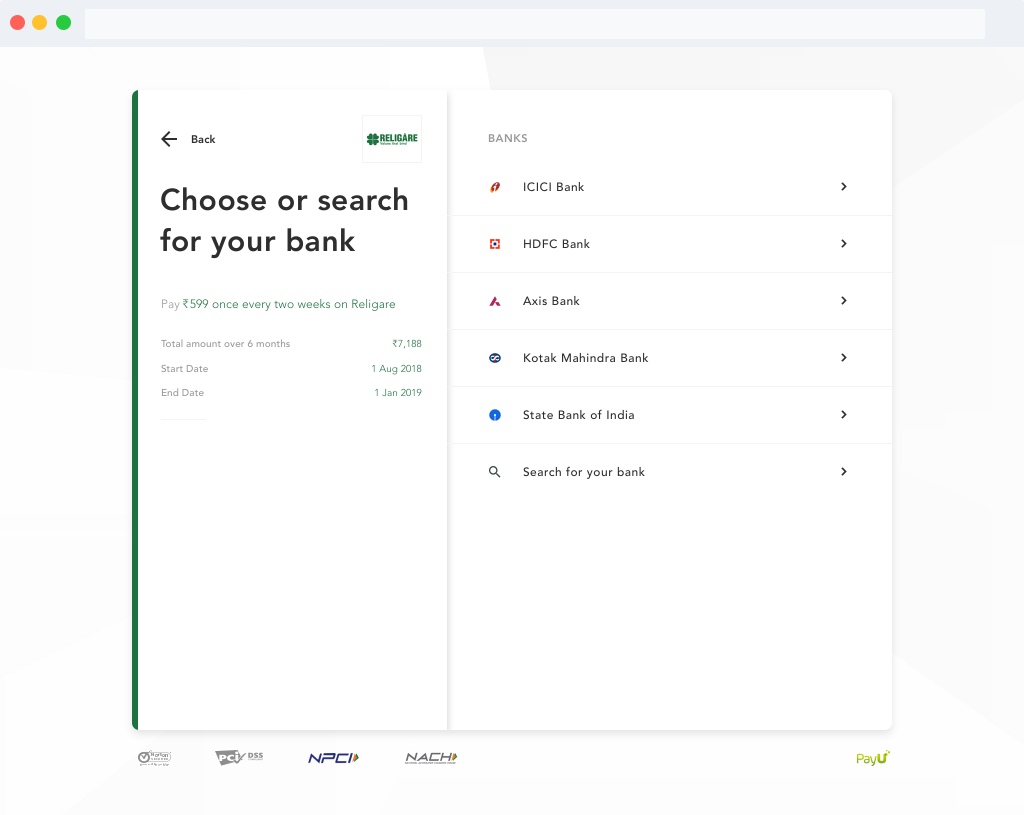

1. On clicking on a subscription plan, the customer will be asked to select his preferred bank from PayU’s checkout page.

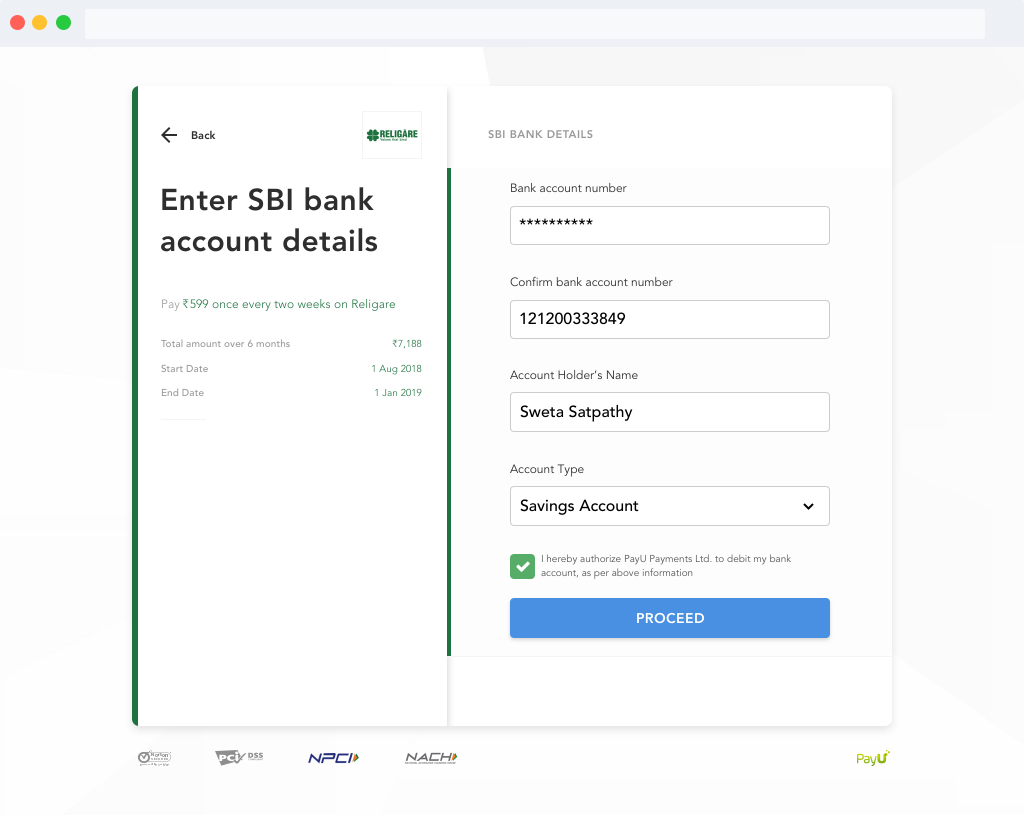

2. The customer enters account details such as account number, beneficiary name, and account type (SAVINGS or CURRENT).

3. Then, the customer is redirected to bank page where he/she needs to log in through Net Banking username and password.

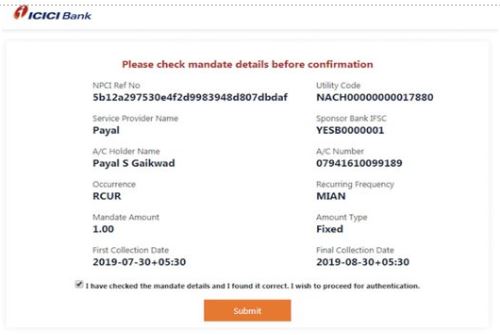

4. On successful login, the customer is shown registration details which cover Subscription plan he/she is opting for the given merchant, inside the bank’s portal.

5. Once the subscription plan is approved by customer then registration response is returned to PayU through browser redirection.

6. PayU captures registration details and takes the customer back to the merchant website.

Conclusion

Subscriptions along with eNACH are the best way to delight customers and grow your business! At PayU, we leave no stone unturned to implement the latest features and updates of the fintech industry for you. To know more about PayU features,

That’s a lovely initiative and I think PayUmoney will bring more customers on its platform. I’m thinking to switch to PayUmoney.

This is really a good feature that businesses like us need to have. All the best team! (Y)