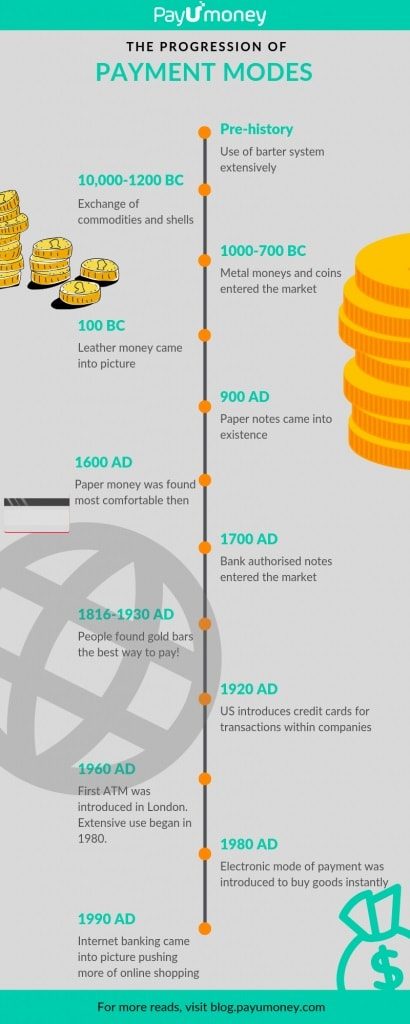

Throughout ages, people have engaged in the exchange of goods and services in return for some mode of payment. These modes of payments were not always financial transactions. There was a time when standard money did not even exist, and people relied on bartering and livestock exchange. With the evolution of technology, money and payments have changed drastically. Today, online payment processing technology has taken over making financial transactions possible anytime, from anywhere! Here’s a quick synopsis of the journey ‘payments’ has traveled:

Online Payment Processing: What Does It Mean?

Now that we know we are at online payment processing era, let us dive deep and understand what online payments mean and look at the pros and cons it offers. Online payment refers to any transaction that is done electronically. It can be via a mobile device or computer or POS machines. This involves the use of an internet network, secure payment ecosystem and coded information, imprinted on your card or your confidential details.

In the war of offline vs online payment processing, the online method seems to be winning so far! Here’s why:

- Online method is quick and easy. You can easily transfer a huge amount of money within minutes

- It offers transparency in each transaction. You can have a record of each transaction hence, reducing payment frauds

- A number of payment gateways like PayUmoney, makes the entire process hassle-free, promising industry best success rates!

- Online payment processing allows you to make a transaction in any part of the world without facing the currency difference

- With the online ecosystem, you can send and accept payments 24*7!

- It allows businesses to offer multiple payment options to its customers like Credit/ debit cards, Netbanking, UPI, Wallets, etc.

Is Online Payment Processing A Necessity?

Historically, cheques were the most preferred payment methods. Organizations wrote, signed and mailed paper cheques as it used to save on costing and mainly because this was the only mode of payment available. But ever since the FinTech came into the picture, organizations and individuals started using electronic payment methods for faster and simpler processing. It saved their time and effort, hence reducing risks and fraud.

A recent report suggests that 81% of businesses find online payment processing better because of all the advantages it offers! This makes it clear that accepting online payments is no more a choice, it is a necessity.

Here’s the endnote: if you want to scale up your business and offer the best experience to your customers, then it is necessary to move in the direction of your customers: ‘online’ with a wide range of payment options. Read our blog on Why Should You Collect Online Payments here!

What’s Next For Businesses?

Newly ventured into an online or rather just created your e-commerce website? Then along with design and smooth interface you need a safe, trusted and fast payment gateway for the website. Now that you know what online payment processing means and what importance it holds in the modern world, the next step is to choose the right payment gateway. Read here to know What Is Payment Gateway For Website And How It Works? Before we understand the pre-requisites for choosing a payment gateway, let us understand why you need a payment gateway for your business:

- Secured & Protected Payments: Payment gateways are highly secured and encrypted. Hence, they protect sensitive customer data such as credit card number, etc., from fraudulent activities or online theft.

- 24/7 Store: Your customers can make a purchase anytime and from anywhere they want to.

- Shopping Cart Convenience – Payment gateways facilitate customers with shopping carts for better shopping and complete checkout experience.

- Tracking Abilities: You can track all your transactions (past and present) all at one place.

- Multiple Modes Of Transactions: Your customers can make use of a credit card, debit card, net banking, UPI and even international cards to make an online purchase on your website/app.

- Multiple Device Friendly: A payment gateway provides smooth payment experience to customers, be it on a desktop, laptop, mobile or a tablet, etc.

- Faster Transaction Processing: A payment service provider is much faster than manual processing. Your customers can make a purchase without any inconvenience of waiting in long queues.

- Integrated Payments & Settlements: The effort of individually reaching out to multiple banks naturally reduces by integrating with a payment gateway. It takes all the load on your behalf so that you can solely concentrate on building your business.

Ones you know why your business exactly needs a payment gateway, take a step further and choose the right payment gateway for your business. You can read here to know How To Choose Best Payment Gateway In India. You may like to consider PayUmoney because of the following features:

- Super quick and free set-up

- Test mode experience

- Easy onboarding and integration

- Advanced dashboard

- Leading E-commerce plugins

- Secure checkout options

- Competitive TDR rates

Currently, PayUmoney is offering services to 4.5 lakh+ happy businesses across the country. It is trusted, instant and secure. Here’s what some of our merchants have to say about their experience with PayU! “

“A successful business is built by people and not by money. We are glad to have found the right people to manage our online finances.” – Abhishek Chandrashekhar, Royal Brothers

“PayUmoney delivers on its promise of being a robust and quick to activate payment gateway. It outperforms to firmly support its merchants” – Arvind Batra, Events High

“PayUmoney delivers on its promise of being a robust and quick to activate payment gateway. It outperforms to firmly support its merchants” – Arvind Batra, Events High

“The payment settlement time is very good. Being a startup liquidity is very important, which PayUmoney has helped to achieve” – Amit Saini, Founder, Let’s Ryde

This is not it! Our robust technology ensures your business gets all its payment-related services under one roof. Some of our industry best innovative products are:

- Web Checkout: Add a completely redirection-less & secure payment gateway on your website

- Plug-n-Play SDK: Accept payments on your Android / iOS app with our customizable SDK

- Platform Plugins: Quickly accept payments on e-commerce platforms – WooCommerce, OpenCart, Shopify etc.

- Payments On MS Excel: Choose the industry-first innovation to accept payments right from your MS Excel

- Payments Button: Just copy-paste a single line of code to accept payments within minutes from your website/ blog

With all your marketing efforts for your business in place, it’s a good idea to have an all-in-one payment solution in place as well. Sign up with PayUmoney to enjoy the best payment gateway experience and grow your business effortlessly!

Leave a Comment