Eagerly waiting for speeches has become a norm during this lockdown. Everyone looks forward to hearing from the government on what steps are being taken to curb the spread of coronavirus as well as revival of the economy. One such speech we were all awaiting was that of Finance Minister Nirmala Sitharaman on her 20-lakh crore economic package. And well, the announcement did bring relief to many businesses, amid this crisis.

In a bid to provide support to millions of micro, small and medium enterprises reeling under the impact of COVID-19 outbreak and lockdown, Finance Minister Nirmala Sitharaman announced a slew of liquidity measures including collateral-free automatic loan worth Rs 3 lakh crore for 4 years. This comes along with PM Narendra Modi’s push for going local!

These measures will provide a big relief to around more than 45 lakh MSME units and help them get back on track. It will help ease the liquidity woes of businesses, improving their working capital, and cash flow.

Booster for MSMEs

- INR 3 lakh crore collateral-free automatic loans for businesses, valid for borrowers with up to INR 25 crore outstanding and INR 100 crore turnover. Such loans will have a 4-year tenor with a moratorium of 12 months on the repayment of the principal amount. The interest will be capped, and the scheme can be availed until October 31

- The government will provide stressed MSMEs with equity support by facilitating the provision of INR 20,000 crores as subordinate debt

- A Fund of Funds being created to infuse approx. INR 50,000 crore as equity into MSMEs. The corpus of the fund will be of INR 10,000 crore

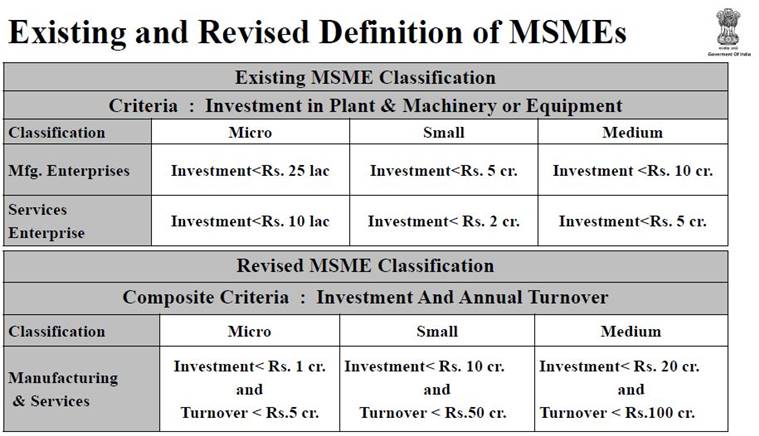

- A new definition of MSMEs – Investment limit to be revised upwards, with additional criterion of ‘turnover’ also being added. This is so that MSMEs can grow and still get benefits. The units having a turnover of up to Rs 5 crore will be called micro-units

- For government procurement, tenders up to INR 200 crores will no longer be on global tender routes. This is to make self-reliant India as also to serve ‘Make in India’

- E-market linkage across the board for MSMEs to help them find their market. Also, the government and CPSEs will honor every MSME receivables within the next 45 days

How Businesses can Avail these Benefits

To avail the benefits and loans announced by the Government, you will need to register your business on the Udyog Aadhaar Memorandum (UAM) portal. You will need to self-certify your business and personal details such as bank account, Aadhaar card number, type of business, etc. There are no charges for registration.

What is UAM?

UAM was introduced to simplify the process for businesses to register themselves under Micro Small Medium Enterprise or MSME by filling a one-page online form. Earlier, the process was quite hectic and time consuming that required handling a lot of paperwork.

However, with the introduction of UAM, things changed as the processes moved online. The primary motive to launch UAM was to offer a way to the government to provide the maximum benefits to businesses in the country, who are registered via MSME through their Aadhaar card number.

Udyog Aadhaar Registration Process

The registration process of Udyog Aadhaar is quite easy. Here’s a simple step-by-step guide to register under MSME for obtaining UAM.

Step 1: Go to the UAM portal

Step 2: Enter your 12-digit Aadhaar number, name and check the box of terms and conditions

Step 3: Click on “Validate & Generate OTP”. You will receive an OTP on your registered mobile number. Enter the OTP. After verification, you will have to fill the online registration form

Step 4: Fill in all the fields in the form:

- Name of the business owner/enterprise

- Category of the applicant – General, SC, ST, OBC, Others

- PAN Number

- Complete postal address of the company/enterprise – district, pin-code, state, email address and mobile number

- Previous registration details of your enterprise

- Date of commencement of business

- Bank Account Details, along with the IFSC code of the concerned branch where your enterprise’s account is active

- Type of Organisation – “Services” or “Manufacturing”

- Total number of workers employed

- Total amount of money (in lakhs) invested in business/enterprise

- National Industrial Classification (NIC) Code

- Details of District Industries Centre (DIC)

Note – You will need to provide supporting documents for all the above-mentioned information in the form, in order to obtain Udyog Aadhaar for your enterprise.

Step 5: Accept the declaration and submit your application

Step 6: Re-enter the OTP sent on your registered mobile number and then click on “Final Submit”

Step 7: Once the registration process is complete, an acknowledgment number will be sent to you via email

Step 8: After verification, Udyog Aadhaar Memorandum (UAM) Number is generated. Please note the same as there is no hard copy that you will receive. Based on this UAM number, you can avail various Central and State government benefits for MSMEs

If you wish to update your Udyog Aadhaar details, click here.

Udyog Aadhaar Registration: Benefits For You

- Exemption from excise, direct taxes and when applying for government tenders, reduction in fee for filing patents and trademarks, loans with credit guarantee and more

- You will be eligible for availing government loans without guarantee, low-interest rates on loan, and easy loan

- Financial backing from the government for participating in global business expos

- Concession in electricity bills

Conclusion

While there are many steps being taken by the government to combat the COVID-19 outbreak and ensure that businesses keep moving forward, it is the responsibility of all of us to follow the guidelines – maintain social distancing and avoid any physical contact by accepting payments digitally!

As India’s leading payment service provider, we have a wide range of products that can help you accept, manage, and reconcile online payments easily – whether your business is online or offline. To know more about our robust stack of products,

Leave a Comment